From May Day to Billionaire Pay Day

Elon Musk, Jeff Bezos, and Company are Fighting to Assure that Wealth Triumphs over Commonwealth in this Latest Struggle Over Who Owns American Democracy

Yesterday was May Day, or International Workers Day as it is still known in some quarters. It is a holiday that commemorates one of the key moments in American labor history and the struggle to make basic economic rights for ordinary people part of American Democracy.

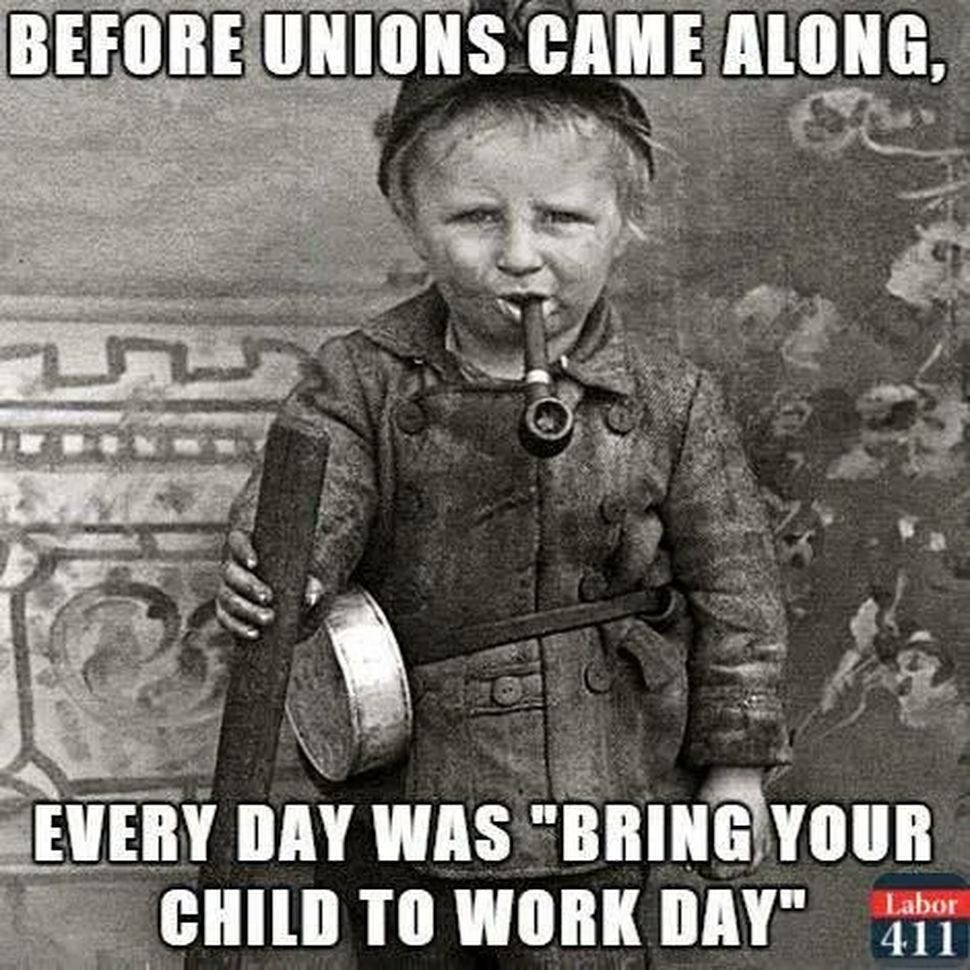

More specifically, in the 1880s a revitalized labor movement took up the issue of the 8-hour day in an effort to end the relentless exploitation of workers. In 1886, laborers in Chicago, led by anarchists, called for a General Strike on May 1st, and they vowed not to return to their jobs unless employers agreed to an 8-hour day.

As historian Jacob Remes notes, “The demands of the militant Chicago anarchists coincided with a massive upswing in other militant movements. Workers and Texas farmers were rebelling against a monopolistic railroad system. The Knights of Labor were rapidly organizing and spreading their vision of a cooperative, rather than capitalistic, society.”

It was more than a general strike; it was a struggle against plutocracy and a call for a cooperative commonwealth where democracy was not controlled by the big money of the robber barons of that earlier Gilded Age.

And while the events at Haymarket Square led to the unjust execution of four anarchists for the death of a Chicago policeman (without any evidence), the larger struggle for the 8-hour day was won, and by the 1930s, the labor movement and the New Deal helped forge a new social contract for American workers. This resulted in a reduction of income inequality by the middle of the 20th century and was the high point of the American middle class.

The decades that followed, however, have seen the slow erosion of the power of labor, and the vast economic inequities that inspired the movement for the 8-hour day have re-emerged and become as deeply entrenched as they were in the latter part of the 19th century.

This was highlighted by a recent Oxfam report in the wake of Tax Day that observed:

On Tax Day, know this: not long ago, the ultra-wealthy paid much more in taxes.

Today, the top .01 percent and giant corporations have rigged the rules so drastically that some billionaires end up paying zero percent. Nothing.

Instead, working families are bearing more than their fair share of the tax burden—at a time when record inflation is steadily eating away at wages.

As a Common Dreams piece on the Oxfam study explained:

[T]he country's 735 billionaires have seen their collective wealth soar by 62% over the past two years while worker earnings have grown just 10%, modest gains eaten away by the rising costs of food, housing, and other necessities.

According to new calculations by Oxfam America, U.S. billionaires now own a combined $4.7 trillion in wealth, much of which goes completely untaxed. As ProPublica recently found in an examination of data from the Internal Revenue Service—an agency that disproportionately targets the poor—the 25 richest people in the U.S. paid a true tax rate of just 3.4% from 2014 to 2018.

"The billionaire wealth explosion in this country comes at a time of historic inflation hitting working families, compounded by the expiration of critical social safety nets put in place at the start of the pandemic to protect America's most vulnerable," said Gina Cummings, vice president of advocacy alliances and policy at Oxfam America.

What could be done if that wealth was adequately taxed, as one of the abandoned proposals in Biden’s Build Back Better package proposed? A whole lot, it appears. Common Dreams again observes of the Oxfam report:

The aid group noted that another $63 billion could be raised by implementing a global minimum tax on multinational corporations, a proposal that the Biden administration and the leaders of more than 130 other countries have backed. But huge obstacles remain in the way of final approval of the tax, given that the legislatures of individual nations have to approve it.

Oxfam found that "the $63 billion a year in corporate tax revenue could allow the U.S. to invest in climate finance, including tax credits for clean energy ($11.4 billion) and cutting carbon emissions with tax credits for consumers and companies ($32 billion); and fund critical public health needs, including funding global Covid health needs ($5 billion), covering the uninsured for Covid vaccines and testing ($1.5 billion), expanding Medicare for hearing ($8.9 billion), and closing the Medicaid gap ($6 billion)."

Here in California, where, as I have written in this space, a wealth tax is currently making its way through the legislature, we are home to more plutocrats than anywhere else in America. According to the Los Angeles Times:

This month, Forbes reported that California has more billionaires than any other state in the U.S. — 186, to be exact. At the top of the outlet’s list of the state’s wealthiest are Google co-founders Larry Page and Sergey Brin. They are followed by co-founder and CEO of Meta Platforms (formerly Facebook) Mark Zuckerberg, former Google CEO Eric Schmidt and Nvidia Chief Executive Jensen Huang . . . As the state generates an astronomical amount of wealth to these select (mostly) men, it is worth Californians questioning if we are fine with the way we are generating wealthy people. After all, with wealth comes power. And of course, as California goes, so goes the nation.

This leads us back to the history I cited in the beginning of this column when the battle between wealth and commonwealth was seen as a struggle for a Democracy as opposed to a Plutocracy.

There was a time in the United States when many people thought that contest had been definitively won in favor of a fairer deal for working people, but that era now seems like a distant dream. At present, the economic and political landscape is a lot more like the bad old days of the first Robber Barons than anything resembling the spirit of the New Deal.

Perhaps that’s why Robert Reich, in the days leading up to May Day, thought to post this on his social media pages:

Robber Barons of the 1st Gilded Age (1870-1900) who made fortunes by monopolizing, bribing legislators, suppressing wages, manipulating finance, and fighting off unions:

John D. Rockefeller

Andrew Carnegie

Cornelius Vanderbilt

JP Morgan

Jay Gould

Henry Ford

Andrew MellonRobber Barons of the 2nd Gilded Age (2000-) who made fortunes by monopolizing, bribing legislators, suppressing wages, manipulating finance, and fighting off unions:

Jeff Bezos

Elon Musk

Bill Gates

Mark Zuckerberg

Charles and David Koch

Larry Page

Carl Icahn

The Walton FamilyThe excesses of the 1st Gilded Age ended with the progressive era -- political reforms, taxes on the wealthy, protections of worker health and consumer safety, and antitrust to break up monopolies.

How will the excesses of the 2nd Gilded Age end?

The answer to Reich’s question may lie in what happens in Amazon warehouses, Starbucks coffeehouses, and a myriad of other workplaces across the U.S. more than in the halls of Congress where the hold of the plutocrats remains firm.

And it’s clear that Jeff Bezos, Elon Musk, and company are doing what they can to assure that wealth triumphs over commonwealth in this most recent round of the ongoing battle for the soul of American democracy.