The Sorry State of Trump-o-nomics

The rich gonna get richer, and the rest of us parasites are screwed

On Tuesday evening, President Donald Trump will address a joint session of Congress. This won’t be a “State of the Union” speech, since those events begin after a president has been in office for a year. None-the-less, Trump loves a stage, and will try to tell enough lies to distract us.

I know it seems like it’s been forever since Inauguration Day, but it really hasn’t. We’re still the smoke and mirrors stage where flashes of light and the bombasity of misinformation don’t add up to what we intuit will happen.

Monday’s stock market crash, the tariffs on Canada and Mexico, the pass-along impacts of government contracts being canceled and federal expertise being thrown away certainly don’t bode well for the economy in the coming months.

The President’s speech before Congress is predictable, namely that he’ll drone uncomfortably through part of what his staff thinks he should say, and then jump from the certainty of teleprompters to tapping into the vast store of victimhood he drags around.

What topics get raised in this context are most likely to be those included in Fox News coverage and whatever social media Trump is exposed to in the hours leading up to his appearance.

Given that the administration is still reacting to pockets of resistance to various measures, I’ll expect more than a passing mention of retaliationary schemes. We’ll see how good his facilities are by the range of pejoratives he uses. If he can’t get past “fraud” and “commies” we can assume his cognitive decline is greater than predicted.

Pay attention to his claims about the economy. Donald Trump is terrible at managing money and good at sponging off other people. In the coming months it’s safe to expect the ‘other people’ will be us.

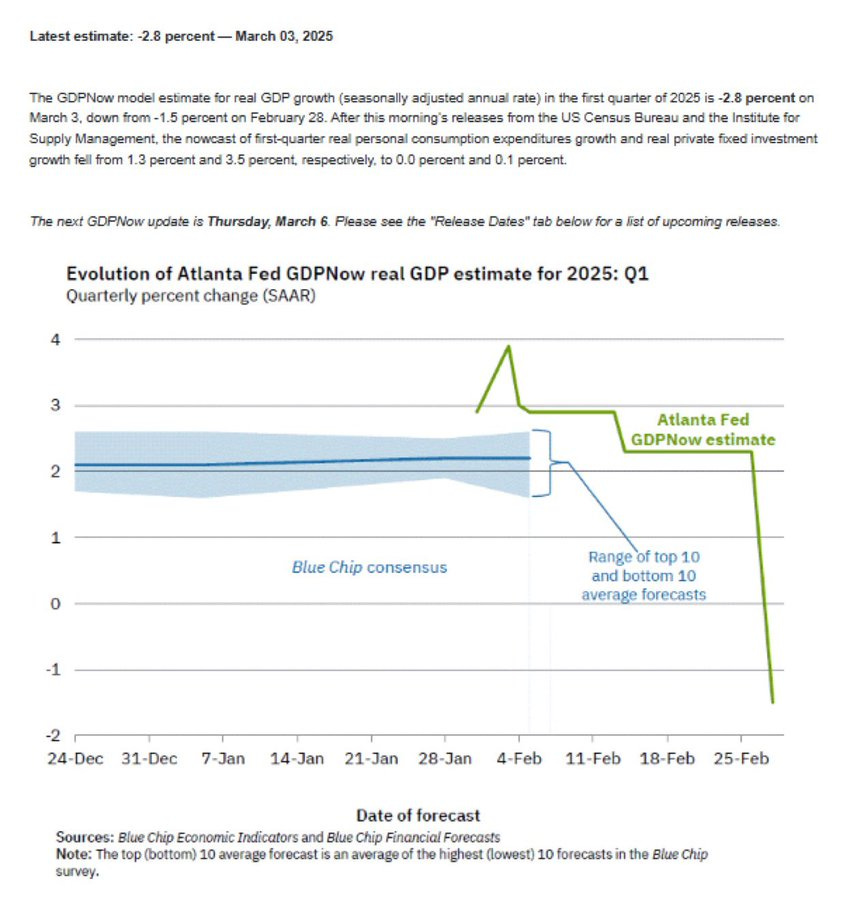

Here’s a scary chart.

I expect to be in the minority for saying I don’t think the impact of tariffs will be as great as advertised by administration critics. The consumer purchasing power at the core of the US economy is now dominated by the wealthy, with the top 10% of earners accounting for 49.7% of all consumer spending. This is a significant increase from 36% three decades ago. They can afford to pay more.

In The US Economy Runs on Billionaire Pocket Change, David Moscrop at Jacobin explains the cycle of wealth enhancement.

Decades of deindustrialization, financialization, and the legacy of Reaganomics — deregulation and tax cuts for the rich — have driven the United States toward a rentier economy, where wealth isn’t made by building things but by owning and exploiting assets. The more passively wealth accumulates, the more complicated the financial instruments behind it, the better. After all, who wants to work or, god forbid, have their debauched financial instruments questioned?

Elon Musk’s fabulous wealth is largely tied to the valuation of the stock in companies he owns. He’s not making big bucks off every Tesla sold or rocket launched; it’s the ability to leverage the perceived value of those companies for cash, which can be helpful in buying Presidents. (This is why the picket lines at Tesla dealers are a great idea.)

***

There are three things beyond stocks and bonds that represent a threat to the current cycle of wealth accumulation: commercial real estate, Artificial Intelligence, and cryptocurrency. Remember, us parasites will be getting the tab for all these bursting bubbles.

There’s a shell game going on with commercial real estate and it’s plainly visible in San Diego if you’re willing to look around. Big properties are being devalued, with a 27.24% price decrease in 2023, the much ballyhooed Horton Plaza project going bankrupt, and the massive life sciences focused property on the waterfront unable to attract tenants.

This isn’t limited to San Diego; retail strip malls and even medium sized shopping centers are emptying out nationwide. Banks are forestalling a default crisis looms in commercial office real estate by rolling over interest only loans made pre-COVID when interest rates were lower.

Given falling occupancy rates, expectations that technology advances will lessen the need for working spaces, and a federal government fire sale of buildings and leases, it’s hard to see past a recession coming for capital parked in looming concrete structures.

***

The ‘cutting edge’ bubbles connected with technology pose an even greater risk. Self-generative artificial intelligence has flashes of brilliance, can automate database analysis, and is sucking up capital at a rate that presupposes a miracle will be forthcoming.

There are accounts nearly everywhere of the challenges ahead in generating enough electricity to feed ever-growing data farming.

But maybe not.

In the past few months Microsoft has effectively abandoned data center expansion equivalent to over 14% of its current capacity. Since it can take three to six years for a data center build out, pulling back on growth is indicative of growing uncertainty about the commercial value of AI.

Microsoft, which arguably has more data than anybody else about the health of the generative AI industry and its potential for growth, has decided that it needs to dramatically slow down its expansion. Expansion which is absolutely necessary for generative AI to continue evolving and expanding.

OpenAI, a company that spent $9 billion to lose $5 billion in 2024, requires so much money to meet its obligations (operations and growth) that it has to raise more money than any startup has ever raised in history — $40 billion — with the cast-iron guarantee that it will need more money within a year.

While companies like Google and Microsoft have incorporated aspects of AI into consumer software, anybody who’s actually used it (and not drank the Kool-Aid) knows it’s not worth the increased prices being levied.

At some point not far down the road there will be reckoning. And unless something miraculous occurs (or self-consciousness arises and decides we suck as a civilization), we’re going to be left with an overvalued pile of promises.

Of all the scary possibilities, I would say the collapse of AI is the hardest to predict. It all depends on investors being willing to throw good money after bad. Can you imagine being told that bailouts for Microsoft and Google are ‘necessary’?

Finally, the third pillar of economic uncertainty is cryptocurrency.

On Sunday, President Trump announced his plans for a U.S. “crypto strategic reserve,” promising to make the U.S. the “Crypto Capital of the World.” This move is the absolutely biggest scam in the history of government finances.

First up, he plans to add five cryptocurrencies to the strategic reserve: Bitcoin, Ethereum, XRP, Solana, and Cardano. We’re not supposed to notice crypto czar David Sacks having a venture firm linked to Bitwise Invests, one of the biggest crypto index fund providers that just happens to hold significant amounts of the very same cryptocurrencies.

A few hours before Trump’s announcement, someone bought $200 million in Ethereum and Bitcoin. Coincidence? I think not, especially since the overall crypto market has been in decline for weeks.

Via the Associated Press:

Crypto prices soared after Trump’s victory last year, and when the price of bitcoin first crossed $100,000 in early December, Trump took credit and posted “YOU’RE WELCOME!!!” on social media.

But prices have fallen since Trump’s inauguration and Trump has faced criticism, including from allies within the crypto industry, for helping launch a personal meme coin just before he took office that has since collapsed in value. The crash of meme coins linked to First Lady Melania Trump and Argentine President Javier Milei, along with a massive hack of a major cryptocurrency exchange that the FBI has said was done by North Korea, have also dimmed enthusiasm for crypto.

“Why is crypto in the toilet if Trump is crypto king?” Dave Portnoy, an influencer and crypto enthusiast, said on social media last week.

A vision central to the crypto belief system is that value protected by encryption could functionally replace gold and allow currency to exist free from government restraints and manipulation.

So far, that ‘freedom’ has amounted to a medium for bribery, extortion, and drug transactions. ‘Hump and dump’ is where the profit comes from with crypto: hype your imagined valuables and dump them once other suckers buy in.

El Salvador, the country that adopted crypto as a legal currency for day-to-day transactions, has abandoned recognition as legal tender in order to get a $1.4 billion lifeline from the International Monetary Fund. The country’s financial woes stemmed from a lack of transparency and blatant corruption in its financial sector, empowered by the very nature of crypto.

So, while our federal budget is being “balanced” by taxing wealthy people less and denying services to the rest of the people, our government will be pumping dollars into a holding whose proven value is at best questionable and at worst a pot of gold for virtual pirates.

All of the above are reasons why any solution to what Trump/Musk has wrought must include leveling the playing field for all of us, providing caps for the top tier, and support for the bottom tier.

Think about it. Who really needs more than a billion dollars? Over even a hundred million?

One lesson that we should all take from this era is that unfathomable wealth leads to a basic breakdown of character.

Originally posted at:

Good article so far. Am going to read the rest later, but we have some quite dark clouds on the horizon.