Project 2025: Defanging Financial Regulatory Agencies

Uber-wealthy want risky investments using working people as a backstop.

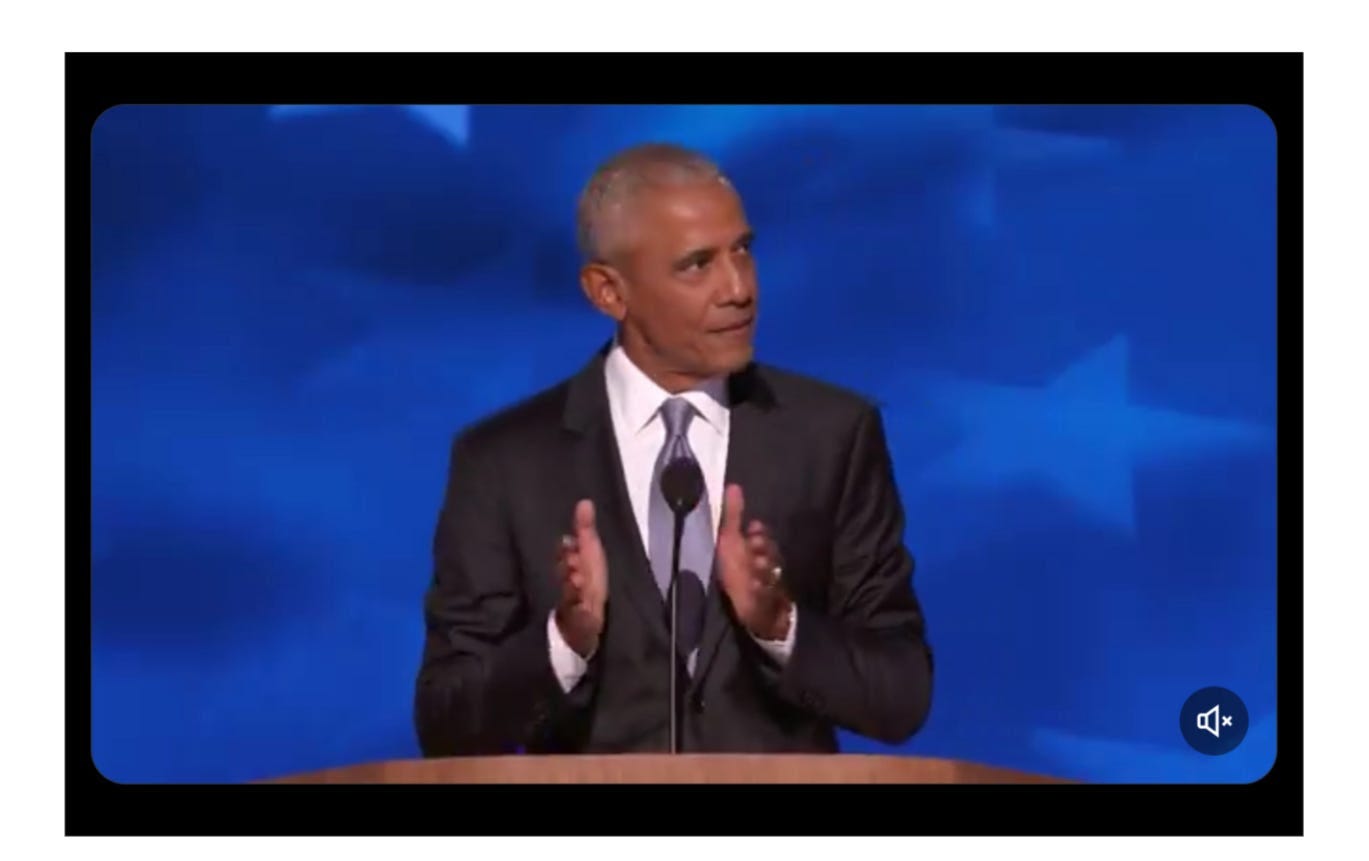

Whoever said that former President Obama’s speeches may have marked the beginning and end of Donald J. Trump’s political career nailed it as far as I’m concerned.

It was Obama’s speech to the White House Correspondents’ Association dinner in 2011 that reportedly angered the New York real estate developer and influenced his decision to run in 2016. And the spectacle of now-professor/president emeritus Obama ridiculing the convicted felon’s obsession with crowd size at the DNC had the effect of pulling aside the curtain to reveal a little orange man trying to project fear at the populace.

Former First Lady Michelle Obama also ridiculed the Republican nominee by wondering if Trump knew he was competing for a “Black job.” I hope her message of “do something” will motivate the Democratic rank and file to do the hard worked needed to defeat the 45th President’s comeback attempt.

What’s not ridiculous about the 2024 Trump campaign is the open manifestations of greed and disdain for the rule of law event in Project 2025’s section on financial regulatory agencies.

Financial Regulatory Agencies. Securities and Exchange Commission and related agencies. Author: David R. Burton*

Nine decades after reforms triggered by the stock market crash of 1929 reactionaries are still whining about requirements for registering and regulating promises made in the process of selling stocks.

Three decades of deregulation and the near-miss of another Great Depression in 2008 haven’t stifled the urges of the uber-wealthy to make risky investments using working people as a backstop.

In fact, the authors of P2025 seek to overturn post-crisis policies that protect consumers, investors, and the stable functioning of financial markets, along with imposing new limits on regulators’ capacity to step in during periods of instability.

They also like to terminate the Consolidated Audit Trail (CAT) program, which facilitates the tracking of trading activity in U.S. equity and options markets. (This data enables identifying misconduct, such as market manipulation and broker leaks.) The number and manner of enforcers world be limited, with investigations capped after two years (anybody remember Bernie Madoff? Or Enron?) and enabling a politically appointed employee to remove civil service managers directing investigations.

In California, where the act of shoplifting has risen to the manufactured crisis level, this would be the equivalent of eliminating store anti theft measures and telling the police not to worry about thefts of merchandise. (I know it’s a bullsh*t equivalency, but so is the fact that thievery is to be enabled in the investment world.)

Consumer Financial Protection Bureau. Author: Robert Bowes.**

The CFPB writes and enforces rules for financial institutions, examines both bank and non-bank financial institutions, monitors and reports on markets, along with collecting and tracking consumer complaints.

Project 2025’s “solution” for the CFPB is to eliminate it.

It seems as though CFPB’s successes in curtailing abusive debt collection practices, reforming mortgage lending, and publicizing complaints from customers of financial institutions, along with extracting $19 billion in refunds and canceled debts for 29 million consumers is somehow overreach.

Laced throughout the rhetoric are measures enabling the scammy side of crypto currency. We’ve had more than a decade to evaluate this “miracle cure” for central banks and all we’ve seen are investor scams, portals for cyber-holdups, and safe haven for illicit proceeds.

Trust me on this. Project 2025’s ideal solution of letting markets solve irregular financial activities is a license to steal.

Individuals will be the victims of free market bandits; individuals like Donald Trump will be allowed to fall up after suckering consumers, the planet will be victimized by P2025’s insistence that climate change is irrelevant to investment.

Finally, companies will be forced to suffer less market share as a tax for preserving the wealth and power of rich white guys. Yes, diversification is a net positive for companies, but it won’t be allowed because it endangers the status quo.

(*)David R. Burton Senior Fellow in Economic Policy in the Thomas A. Roe Institute for Economic Policy Studies at The Heritage Foundation. He is a former General Counsel at the National Small Business Association and manager of the US Chamber of Commerce’s Tax Policy Center.

(**) Robert Bowes is a former banker who worked at HUD in 2017; he was appointed to the US Commodity Futures Trading Commission in 2020. He has referred to the Securities and Exchange Commission as an “unaccountable meddling shakedown agency” that “uses its regulation to target political enemies, to ram through woke and radical green agenda.”

***

Tomorrow: The Federal Communications Commission

***

Previously:

(Intro) Digging Deep into Project 2025 - (a multi-part Series)

Going Deep into Project 2025 - Partisan Priorities for Civil Servants

What Can You Do For Trump Today? Project 2025’s Diplomats, Spies and Spokespersons

Make America Dirty Again: Project 2025 on Energy and the Environment

Project 2025: Some (Christian) People Are More Equal Than Others

Going Nowhere Faster - Project 2025’s Department of Transportation

Weather by [color descriptor redacted] Marker Pen: Project 2025's Department of Commerce

Project 2025: Looting and Booting at the Department of Treasury

Finance, Purgatory and Paradoxes in Project 2025 (Import/Export Bank, Federal

Reserve, Small Business Administration)

***

Wednesday News to Peruse

***

In Chicago: Women Who Vote and the Men Who Love Them by Nina Burleigh at American Freakshow

No nation on Earth - not even the Scandinavians - are completely free of the weight of millennia of patriarchal traditions. The MAGA era explosion of fury against women is at some level just a primitive male fear response to the unprecedented freedoms that science, access to education and birth control have brought to American women.

The light of the Democratic Convention in Chicago right now won’t dissolve this pattern. The new era Kamala Harris and Tim Walz will usher in won’t detoxify the unhappy men whose unearned confidence - instilled in them by reactionary churches and parents who insist on hierarchies that seat men next to God and women down with farm animals - is under threat.But here in Chicago this week, there is a palpable sense of a turning, a shift in the matrix, just as powerfully present in the crystal clear summer light over Lake Michigan as was the lowering darkness in Cleveland in 2016.

***

Taxpayers cover tuition at California’s for-profit schools. The results? Low-wage, high-turnover jobs by Adam Echelman at CalMatters

In 2022, California spent nearly $61 million of taxpayer dollars from the federal Workforce Innovation and Opportunity Act to support job training, typically for low-income and unemployed adults, according to the most recent data available. It’s one of the largest job training programs in California — designed by the federal government to prepare students for high-quality jobs.

The reality is far different.

Most adults who receive job training assistance get a tuition subsidy — over the past six years about half of those subsidy recipients went to private for-profit colleges — yet some of the most popular programs were for medical or nursing assistants, whose graduates earned less than $30,000 in the year after graduation, according to student outcome data collected by the state’s Employment Development Department.

***

Oil firms and dark money fund push by Republican states to block climate law by Peter Stone at The Guardian

Earlier in May, 27 Republican attorneys general and industry trade groups filed lawsuits to block the Environmental Protection Agency from going forward with a new Biden administration rule that requires coal-fired power plants and new natural gas plants to make large-scale reductions in carbon emissions.

The EPA rule, which had just been approved in April, requires existing coal-fired plants and many new ones to cut their emissions by 90% by 2032 which could require billions of dollars in new expenditures.

Furthermore, this April, 20 Republican attorneys general filed a petition asking the supreme court to intervene in a major lawsuit brought by Honolulu against Sunoco and slated to go to trial later this year that seeks billions of dollars in damages from major oil companies for misleading the public about climate crisis-related disasters.